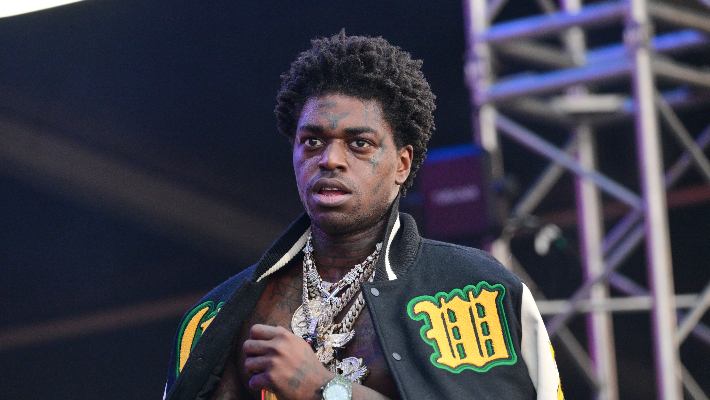

Kodak Black has had a few unfortunate runs with the law in the last two years. Since his release from prison in February, the “Last Day In” rapper has kept a relatively low profile.

But it appears his alleged past actions are catching up with him. According to HipHopDX (a fellow subsidiary of Warner Music Group), Kodak is being sued by a transportation service company for unpaid services.

In the documents filed on March 27, I&D Concierge, a limo company based in Queens, New York, accused Kodak of supposedly racking up a tab of $618,070.10. A representative for the business alleged that for several months, Kodak would average out six figures in transportation needs.

However, Kodak Black’s attorney, Bradford Cohen, spoke with TMZ. “I&D took full advantage of his client when he was going through a rough patch,” he said. “And capitalized on the situation.”

Cohen alleges that I&D “ran the clock” when Kodak would call for a car. Due to the hour-long wait, Kodak decided to order an Uber instead, forgetting to cancel his initial request with I&D. However, the I&D driver arrived at his home and sat there until Kodak came back; the company went on to bill him for up to 16 hours.

Read the full excerpt listed in the court paperwork below.

Commencing in September 2018, the defendant engaged Plaintiff’s services and began using Plaintiff for its transportation needs on a regular basis. From September 2018 to December 2023, Defendant’s charges with Plaintiff averaged approximately $150,000 to $200,000 per month.

Between January 2023 and December 2023, in accordance with the agreement and terms between the parties, as well their course of dealing, Plaintiff provided Defendants, pursuant to their specific instance, request and confirmed order, the following services totaling $618,070.11 (the “Charges”).